Michael Kachmar, Editor

(If not displaying properly or banners not loading, click here.)

A Message From the Editor

A note of thanks for the support we've received over the past fifteen years. It's truly been overwhelming, beyond any expectation.

We launched to fill the need for timely, focused, non-biased news for resellers of POS & Auto ID. If anything, that need grows more pressing in the face of head-snapping changes in technology, go-to-market strategies, and business models.

We look forward to continuing our mission, and welcome your suggestions and thoughts on improvements. Wishing you and your family health, happiness, and prosperity in 2019!

Michael Kachmar, Editor

From January 8: TSYS Takes Cayan

Another indication of the key role of integrated payments: Cayan (Boston, MA) has been brought into the fold of TSYS (Columbus, GA). Founded in 1998 as Merchant Warehouse, Cayan has been one of the most active payment processors in the channel for POS. A portfolio company of Parthenon Capital, it's best known for its Genius Customer Engagement Platform (which handles MSR, EMV, and NFC). It serves more than 70,000 merchants and 100 partners in the U.S. (On its part, TSYS processed about 25.5 billion transactions in 2016.)

"Acquisition of Cayan strategically complements our merchant goals to become a leading payment solutions provider to small- and medium-size businesses in the U.S. by delivering best-in-class services and solutions," declared M. Troy Woods, Chairman, President, and CEO of TSYS. "TSYS already has tremendous scale and distribution capabilities. Addition of Cayan's unified commerce solutions puts us in a strong competitive position to jointly offer a broader set of value-add products and services to our partners and merchants."

"Cayan and TSYS are aligned in our strategy to provide cutting-edge payment solutions and a robust product offering to merchants across the U.S.," contributed Henry Helgeson, Co-Founder and CEO of Cayan. "We're excited about the opportunity to bring innovative products to a broader customer base." An all-cash transaction valued at $1 billion will close in Q1 2018. An obvious question: Who's next?

M. Troy Woods, CEO of TSYS, and Henry Helgeson, CEO of Cayan (Purchased by TSYS)

From January 22: A Light Shines on Shift4 Payments

At the beginning, there was United Bank Card, then Harbortouch, then Lighthouse Network. Now, following the purchase of the payment processor Shift4 Corporation (Las Vegas, NV), Jared Isaacman's ensemble--comprising Harbortouch, Future POS, POSitouch, and Restaurant Manager--has been rebranded as Shift4 Payments (Allentown, PA). Adding to its powerful family of software, hardware configurations, and philosophy of "POS-as-a-Service," it now adds the well-established gateway by Shift4 (dubbed "Dollars-on-the-Net").

Founded in 1994, Shift4 holds 11 patents for proprietary payment technologies, and helped pioneer data tokenization, point-to-point encryption (P2PE), and EMV. It processes in excess of $60 billion annually and, when combined with the former Lighthouse Network, will process in excess of $100 billion annually. Customers include widely recognized brands such as Caesars Entertainment, Choice Hotels, the PGA Tour, Red Roof Inn, and Sleep Number. (It was only last year, readers will recall, when Isaacman purchased its trio of key ISVs in hospitality POS--Future POS, POSitouch, and Restaurant Manager.)

"This acquisition is transformational for our organization as it enables us to power our industry-leading POS brands with a best-in-class payments platform that is second to none in terms of security, reliability, and functionality," relayed Isaacman, who serves as CEO of the new Shift4 Payments. "But this story is not just about Harbortouch, Future POS, POSitouch, and Restaurant Manager, as we also aim to empower the over 300 existing Shift4 software integrations with game-changing benefits." Acquisition terms were not disclosed by Lighthouse Network or Shift4 Corporation.

Jared Isaacman, CEO of Shift4 Payments, Successor to the Lighthouse Network

Worth Your While

NRF's Big Show

National Retail Federation

January 13-15

New York, NY

Inspire

Retail Solutions Providers Association (RSPA)

February 3-6

Fort Myers, FL

NGA Show

National Grocers Association

February 24-27

San Diego, CA

ProMat

Material Handling Institute (MHI)

April 8-11

Chicago, IL

ETA Transact

Electronic Transactions Association

April 30-May 2

Las Vegas, NV

NRA Show

National Restaurant Association

May 18-21

Chicago, IL

Pack Expo

Packaging Machinery Manufacturers Institute (PMMI)

September 23-25

Las Vegas, NV

From February 5: A Tale of Two EP's -- Epson & Electronic Payments

Epson America (Long Beach, CA) has received certification for its Model TM-m30 receipt printer from payment processor Electronic Payments (Calverton, NY). It will be bundled with so-called Exatouch POS Software from Electronic Payments. In addition to POS, Exatouch has modules for inventory and purchasing, staff scheduling, customer relationship management (CRM), and back-office reporting. A number of liquor stores in Ohio are early installs, according to the two parties.

"We've invested significant time and resources in developing industry-leading point-of-sale software and wanted to pair it with industry-leading hardware that is equal in reliability and performance," expressed Michael Nardy, Founder and CEO of Electronic Payments. "We've worked with Epson in the past, and we've found that their products uphold their reputation and credibility. When coupled with Exatouch, we deliver the best possible merchant services experience."

Introduced in 2015, Epson's 3" TM-m30 features symmetrical, cubist dimensions of 5 in. x 5 in. x 5 in., modular case, which enables either top load or front load configuration, and automatic paper cutter and rapid paper roll replacement. Offered in black or white, it has maximum print speed of 7.9 in./200 mm per second at 203 dpi. It has the company's "ePOS" technology for web-based applications and easy set-up with iOS, Android, and Windows. As choices in connectivity, there's combination of USB, Ethernet, 802.11a/b/g/n Wi-Fi, and Bluetooth

Electronic Payments Certifies Epson's TM-m30

From February 18: An Entire Code

Code Corporation (Salt Lake City, UT) has launched its new service-focused program, entitled "Code Complete." It seeks to facilitate product selection, deployment, and maintenance. A longtime supplier of scanning technology to our channel, Code has divided this program into three parts: "Connect" (e.g., site surveys, customer meetings, workflows), "Select" (e.g., choice of product, installation, training), and "Protect" (e.g., updates, warranties, RMA's).

"We know that each company has different needs in terms of products, service, and support," explained John Deal, VP of Product Strategy for Code. "By creating this comprehensive suite of solutions to support our customers before, during, and after rollout, we've helped them get the most out of their investment." Added Jennifer Braun, Program Manager, "We care about our customers, and we want them to expect more out of us than just shipment of products."

Elsewhere, Code and Honeywell (Fort Mill, SC) have resolved their patent infringement lawsuit. Under terms of the settlement, Code will pay an annual royalty fee--as well as one-time lump sum payment--to license certain patents of Honeywell. "We acknowledge the value of Honeywell's patent portfolio relating to barcode scanning technology," stated George Powell, President and CEO of Code Corporation. "Having access to this technology will benefit Code's customers."

George Powell, President and CEO, Code

Join the Party at No Charge

|

|

|

|

|

|

||

|

|

||

|

|

|

|

|

|

||

Do you need to reach the POS & Auto ID resellers who really drive business? With the most targeted editorial environment, and on the most cost-effective basis?

E-mail

Michael Kachmar for advertising information,

or call 973-270-3284

Did you miss one of our issues and suddenly realize your competitors know more than you do?

Hurry ! Use the links below to catch up :

From March 5: Silver Linings for CloudPRNT

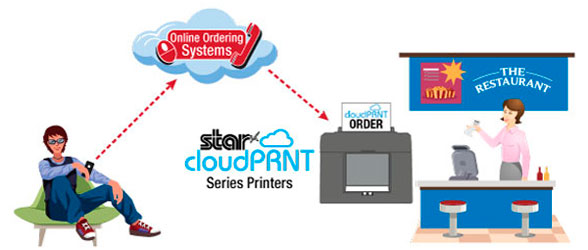

Star Micronics America (Somerset, NJ) has expanded the scope of its cloud-based print methodology, which communicates directly with the server, employing JavaScript Object Notification, and entitled "CloudPRNT." It now supports text-based receipts and "micro receipt" for the proprietary AllReceipts Digital Receipt Service with the following Star Micronics thermal printers: TSP650II, TSP700II, and TSP800II. It also provides improved SSL for Star's WebPRNT with self-certification for Google Chrome Version 58. (As primary usage, CloudPRNT addresses online ordering.)

In addition, CloudPRNT connectivity has been extended with support for three new Wi-Fi dongles (specifically, TP-LINK Archer T4-U Version 2, D-Link DWA-182 Revision C1, and LINKSYS WUSB6300). As well, Star Micronics has simplified the configuration settings with the added ability to configure the CloudPRNT URL via USB Drive. It allows customization of the disconnect message if the network is lost (via the USB Drive). Plus, with the new buzzer control function, an order will never be missed or overlooked.

"We are always looking for ways to increase our solutions' features and further extend the value those solutions provide for our customers," commented Christophe Naasz, Director of Business Development at Star Micronics America. "With these CloudPRNT innovations, our customers will have added flexibility and functionality that will not only mean greater ROI from their investment, but also smoother workflows and the ability to offer enhanced customer experiences." In January, Star Cloud Services added two new solutions: PromoPRNT and POS Signage.

Star Micronics Expands Scope of CloudPRNT

From June 4: Datacap Engages the Clutch

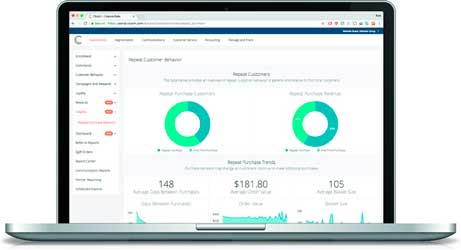

An interesting move into third-party value-added services for payment middleware provider, Datacap Systems (Chalfont, PA). As an initial offering, Datacap (renowned for its "NETePay") has retained the customer relationship management (CRM) solution from Clutch (Ambler, PA). Established in 2012, Clutch furnishes services for gift, loyalty, stored value, mobile, e-mail, and direct mail. It reportedly reaches 120 million consumers of 900 brands.

"We're thrilled to announce the news of our gift and loyalty integration with Datacap," related Andy O'Dell, Chief Strategy Officer at Clutch. "We know that loyalty members spend 20% more than non-members, so the ability to manage enrollment in a secure and responsible manner while increasing revenue is a huge advantage for businesses of all kinds." On its website, Clutch also shows partnerships with processors Cayan (Boston, MA) and Shift4 Payments (Allentown, PA).

"Integration to the Clutch platform represents a significant value-add for Datacap's partners in POS," suggested Justin Zeigler, Director of Product Strategy at Datacap Systems. "Our providers in POS can now present additional value to their merchant clients by offering loyalty, gift, and marketing services to help business owners better engage their customer base." A full rollout of the new value-added services platform--promising recurring revenue--by Datacap Systems was planned for Q4 2018, RRN.Com was told.

A Value-Add Services Platform at Datacap Includes Clutch CRM

Code Corner

Questions for End-Users

#1) Is your current POS system outdated, lacking the reporting and inventory management tools you need to compete?

#2) Is your POS system designed specifically for your industry?

#3) Can you access your back-office functionality anytime from any device?

#4) Do you have to pay to upgrade your software? Or pay extra for customer support?

#5) Do you have to pay for your integrations with third-party software?

#6) Can you connect an e-commerce website to your POS for an omnichannel solution?

#7) Are your retail reports providing you with the right data to help you make smarter decisions?

#8) Are you considering opening more locations?

#9) Do you have to use the credit card processor your software tells you to?

#10) Would you like to better manager your customer relationships and be proactive about curating their experience?

Source: Springboard Retail (Boston, MA)

From June 4: A Trifecta at Posiflex

A virtual executive headquarters, entitled the North American Corporate Office, or NACO, has been established by Posiflex Technology. It will leverage the resources of the company's three powerful entities: Posiflex Business Machines (in POS), Kiosk Information Systems (in Self-Service), and Portwell (in Embedded Computing). As readers may recall, Posiflex purchased Kiosk Information Systems (Louisville, CO) for $105 million in August 2016, and Portwell (New Taipei City, Taiwan) for $181 million in July 2017.

A channel division of NACO will be guided by familiar industry figure Doyle Ledford. In addition to his current role as VP of Sales and Marketing for Posiflex Business Machines, Ledford now serves as Director of Channels of NACO. "His extensive knowledge and success building channel sales and partners will be an integral part of NACO's overall growth strategy," testified Posiflex.

Also named to executive roles: Allen Lee, CEO of Portwell, as Managing Director of NACO, and Tom Weaver, former CEO of Kiosk Information Systems, as Chief Strategy Officer of NACO. According to Owen Chen, CEO of Posiflex Technology, "The vision in this very specific acquisition strategy was to bring three best-in-class companies together to provide the most complete and sophisticated computing solutions from on-line to off-line (O2O) applications in this high-growth era of Service IoT." A new force, with obvious synergies, NACO.

Doyle Ledford, VP of Sales and Marketing of Posiflex Business Machines and Director of Channels of the New Posiflex Technology North American Corporate Office

From June 18: The Life of Riley

A familiar face has emerged as the CEO of Retail Management Hero (Napa, CA): Jeff Riley. A former CEO of Dinerware (2004 to 2015), Riley led the successful sale of that hospitality ISV to Heartland Payment Systems (now Global Payments). In the past, he served as GM of Retail Business Solutions within Microsoft Dynamics (1999 to 2004). He joins Retail Management Hero from the Corum Group, where he was VP of Mergers & Acquisitions (2017 to 2018).

Introduced in May 2016, Retail Management Hero (RMH) replaces the soon-to-end Microsoft Dynamics Retail Management System (RMS). Arising from two entities, Retail Hero and Retail Realm, RMH, in the manner of Microsoft RMS, specifically addresses the SMB. An upcoming launch of enterprise-level RMH Central will take place at the Retail Realm Partner & User Conference in August 2018 in Las Vegas, NV.

"SMB retailers face tremendous opportunities as well as challenges in using technology to advance their businesses. At Retail Management Hero, we are building a product and a partner-based delivery system that is tailored specifically with these needs in mind," remarked Riley. "Joining Retail Management Hero reunites me with many of my former customers and partners from my time at Microsoft, and I am really excited to help lead the journey from here."

Jeff Riley, CEO, Retail Management Hero

Key Advertiser Links

Be sure to visit these vendors for the latest in channel products

and offers for resellers.

POS & Peripherals

Aures

Bematech

Electronic Payments

Harbortouch

Hewlett-Packard

Pioneer POS

POSBANK USA

Posiflex

Toshiba GCS

WooPOS

Barcode & Transaction Printers

Brother Mobile

CognitiveTPG

Godex Americas

Cash Drawers

APG Cash Drawer

MMF POS

Data Collection

CipherLab

Code Corporation

Janam Technologies

Integrated Payment Solutions

Cayan

Datacap Systems

Electronic Payments

Paysafe

Sterling Payment

Keyboards & Mobile POS

TG3 Electronics

Mounts for POS

SpacePole

Receipt Printers

Bixolon America

CognitiveTPG

Epson America

Fujitsu

Star Micronics

Thermal Printers

Seiko Instruments USA

From July 7: ACCESS to Brother Mobile

Brother Mobile Solutions (Westminster, CO) has unveiled its new ISV Partner Program, entitled ACCESS. A section of Brother's THE NEXT Partner Program, ACCESS furnishes custom product configurations, solution integration, engineering software support, and marketing resources for ISVs. Examples include demo and evaluation programs, software development kits (SDK), free printer hardware, and Partner Portal. Application to the program is open to ISVs of every size, according to Brother Mobile Solutions.

"This program is one more step in our mission to help build out and increase the capabilities of many vertical market software developers and ISVs," expounded Ravi Panjwani, VP of Marketing and Product Management for Brother Mobile Solutions. "As we see the traditional Auto ID VAR channel changing shape and mission, engaging with and supporting software developers has become a critical mission for us. Today we're actively working to build a broader knowledge base and drive industry innovation by supporting the developers of tomorrow's mobile apps and related software."

"If you're an ISV out there with mobility on your mind, becoming a Brother Partner can help you increase your presence in the marketplace, improve your solutions, deliver greater market value, and boost revenues," reflected Nick D'Alessio, Senior Manager of Business Development (and ACCESS Manager) for Brother Mobile Solutions. "When it comes to technology partnerships, we have the experience, the engineering know-how, an award-winning line of rugged mobile and label printers, and a wide array of marketing, pricing, and support resources to help ISVs thrive." Brother Mobile rolled out THE NEXT Partner Program for VARs in September 2017.

Heading the Effort: Ravi Panjwani, VP of Marketing and Product Management, and Nick D'Alessio, Senior Manager of Business Development, at Brother Mobile Solutions

From September 17: An Engagement--Ingenico and Toshiba GCS

A collaboration between two powerhouses--in payments, Ingenico (Alpharetta, GA) and in POS, Toshiba Global Commerce Solutions (Durham, NC)--bears watching. As part of this new effort, the popular SurePOS, ACE, and TCx POS from Toshiba GCS will be paired with the next-generation Telium Tetra Solution by Ingenico (and its Lane/7000 and Lane/8000 "Smart Terminals"). A consolidated solution, now under evaluation in customer labs of major retailers, will flow to market via the partner network of Toshiba GCS, RRN.Com was told.

An improved model in which solutions are supported and maintained throughout the entire customer lifecycle was cited as one of the key drivers in this partnership. "Not only do we want to offer our customers best-in-class choices when it comes to payment solutions, we want them to know we're committed to pushing the boundaries of innovation as consumer preference and technology evolve," indicated Steve Markham, SVP of Strategy and Portfolio at Toshiba GCS. Cited as immediate benefits of payments by Ingenico: certification to PCI PTS v5.x, universal acceptance (MSR, EMV, NFC), and eWIC/EBT.

Although this relationship is not exclusive, it foretells further synergy between Ingenico and Toshiba GCS. As likely areas of development, there's mobility, customer engagement, and even payment device management, RRN.Com was told. "In today's environment, you need partners willing to work together to make solutions successful in the long run," stressed Mark Bunney, Director of Go to Market Strategy at Ingenico Group, N.A. "I think this shows that level of engagement."

Alliance Includes Lane/8000 From Ingenico

Channel Factoid

On Tap for 2019#1) Retailers will need to invest more in their workforce.

#2) AI will help retailers stay competitive.

#3) Retailers that offer compelling in-store experiences will flourish.

#4) Small-format stores will be much more productive.

#5) Choice and flexibility, particularly at the last mile, will be more important than ever.

#6) Virtual assistants and voice search will play a bigger role in the consumer journey.

#7) Back-office solutions and innovations will be at the forefront for many retailers.

#8) Emerging payment options, such as mobile and "buy now/pay later," will gain traction.

#9) Geopolitical and economic factors will keep retailers on their toes.

#10) Sustainability will be a major focus for many.

#11) Retailers will turn to new metrics to gauge performance.

#12) Mobile messaging will give many retailers a competitive advantage.

Source: Vend (San Francisco, CA)

From October 22: POS-X Clears Custom's

A leader in ticketing, printing, and scanning technology, Custom America (Boothwyn, PA) has sped into point-of-sale with the acquisition of POS-X LLC (Bellingham, WA). Its parent company, Custom Group SpA, based in Italy, has established its strong presence in POS in Europe, and in combination with POS-X, now Custom America has the U.S. and Canada. A major player in our channel, POS-X will continue to be led by Dan Moseley, Executive Chairman, and Karl Schoessler, CEO.

"We are delighted to be a part of a larger global company with over 600 professionals, as it provides us with resources needed for continued growth," Schoessler told RRN.Com. "We now have the support of Custom Group's more than 120 hardware and software engineers, access to global support centers, and world-class manufacturing facilities. This is an excellent partnership as it should result in new opportunities for both companies."

As CEO of Custom America, Nicola Ciarlante emphasized several benefits of the acquisition, including an increased presence in the hospitality and retail industries, complementary product and service offerings, enhanced market intelligence, and an ability to deliver fully integrated solutions. Having joined Custom America in 2012 as CEO, Ciarlante may be familiar to readers of RRN.Com from his time as Director of the Specialty Products Division at OKI Printing Solutions (2007 to 2012) and Senior Marketing Manager at Metrologic Instruments (2002 to 2007). In the short term, not much will change in dealing with POS-X, RRN.Com was told.

Nicola Ciarlante, CEO of Custom America, Which Has Purchased POS-X

From November 5: In NCR's Flight Plan--Payments

Add payments to the POS offered by NCR (Atlanta, GA), following its purchase of processor and payroll provider JetPay (Allentown, PA). A price of $184 million has been set, or $5.05 per share of JetPay, which represents a multiple of 2.9 times its consensus revenue forecast of $63.4 million in 2018. In addition to increased "stickiness," of course, this move into payments continues NCR's shift to software and services.

"Acquisition of JetPay is a key, strategic initiative that will enable NCR to create a full, end-to-end integrated payments offering for its enterprise-wide POS customers," proclaimed Michael Hayford, President and CEO of NCR. "Enabling payments as part of our transactions is part of our long-term strategy to create integrated value for our clients." In its recent reporting of Q3, NCR has revenue of $1.55 billion, down 7%. Software was up 2%, driven by cloud growth of 6%. Service was up 4%, while hardware fell 20% (for POS, 28%). (All figures on constant currency basis.)

Approved by each company's board of directors, the deal will close in Q4 2018. It will be financed with a combination of cash on hand and existing capacity under NCR's revolving credit facility. A pair of JetPay's major stockholders, private equity firm Flexpoint Ford and payment processing executive (and JetPay's Chairman of the Board) Larry Stone, have agreed to tender their shares in support of the transaction. One wonders what took so long for NCR.

Michael Hayford, President and CEO, NCR

PinPoint Media

All Rights Reserved