Michael Kachmar, Editor

(If not displaying properly or banners not loading, click here.)

Our Product Pick

NCR Corporation (Duluth, GA) has launched its NCR Silver Quantum. About 13 inches in width, described as an "all-in-one commerce station," the NCR Silver Quantum integrates payment device, customer display, loyalty scanner, and 10" Android Samsung Galaxy Tab A. Its embedded RP457c card reader from Ingenico accepts the range of payment methods--MSR, EMV Chip, and contactless NFC (such as Samsung Pay). A 10-hour battery allows cordless operations. Available with NCR Silver Android POS, it will soon add NCR Silver Pro Restaurant Android POS. Interestingly, businesses may remotely set up and customize their NCR Silver Quantum via the cloud-based service, Samsung Knox Configure.

NCR Silver Quantum

COMPANY BUSINESS

It's a Wide, Wide Worldpay

A new executive team for the combined entity, Vantiv/Worldpay (which will be called, ultimately, Worldpay). As the designated Executive Chairman and Co-CEO, Charles Drucker, formerly President and CEO at Vantiv (Cincinnati, OH), will lead the company's strategic functions. As the designated Co-CEO, Philip Jansen, formerly CEO at Worldpay (London, U.K.), will lead the company's go-to-market and new sales efforts. A number of additional executive changes were named as part of this transaction, under which Vantiv will pay $10 billion for Worldpay. It's expected to close on January 16, 2018.

Of particular interest to our channel, Matt Taylor, who currently serves as Group President of Integrated Payments and Emerging Payments at Vantiv, has been promoted to EVP of the new Global Integrated Payments and SMB eCommerce Business at Vantiv/Worldpay. Before its acquisition by Vantiv in 2014, Taylor served as CEO of Mercury Payment Systems. As readers will recall, Mercury helped forge the role in payment processing played by ISVs and VARs in traditional POS.

"Our new executive team leverages the strong talent of the two companies," observed Drucker. "We've designed the combined company executive roles in line with the strategic rationale of the transaction, ensuring that we will capitalize on the revenue opportunities and cost synergies before us." Added Jansen, "Given the robust integration planning we've been conducting over the past several months, we expect our integration to be seamless for our clients and partners."

Matt Taylor, EVP, Global Integrated Payments and SMB eCommerce, for Combined Vantiv/Worldpay

[Editor's Note: More news of consolidation in payments. At press time, TSYS (Columbus, GA) announced it will buy Cayan (Boston, MA). A portfolio company of Parthenon Capital, Cayan fields its Genius Customer Engagement Platform for ISVs and VARs in POS. Purchase price: $1 billion.]

BlueStar Finds Its Keys

BlueStar (Hebron, KY) has received Point-to-Point Encryption (P2PE) Validation from the Payment Card Industry (PCI) Council. With new capacity to establish relationships with payment processors and gateways utilizing advanced data security, via P2PE, the key injection facility expands its footprint at BlueStar. As one of the key injection facilities with P2PE, BlueStar, listed as United Radio, Inc., is now featured on the website of the PCI Council.

"Security is top of mind for all our partners and is crucial in delivering POS solutions today," indicated Jason Firment, new Director of Electronic Transactions Business at BlueStar. "Our partnerships in the payments space continue to grow every day and we see the importance of providing this type of service to all our payment transactions partners. You will also begin to see this added to our POS as part of our trademarked 'In-a-Box' Series."

As one of the "big three" distributors in POS and Auto ID, BlueStar opened its key injection facility in 2016. Its two main competitors, ScanSource (Greenville, SC) and Ingram Micro Advanced Solutions (Irvine, CA) have been active in M&A, snapping up the large independent distributors of payment processing hardware and related services (and end-user customers). In July, ScanSource purchased POS Portal (Sacramento, CA); in November, Ingram Micro Advanced Solutions purchased The Phoenix Group (St. Louis, MO). More to come?

Jason Firment, Director of Electronic Transactions Business, BlueStar

Worth Your While

NRF's Big Show

National Retail Federation

January 14-16, 2018

New York, NY

Inspire

Retail Solutions Providers Association (RSPA)

January 28-31, 2018

Waikoloa Beach, Hawaii

Shoptalk

March 18-21, 2018

Las Vegas, NV

Transact

Electronic Transactions Association

April 17-19, 2018

Las Vegas, NV

NRA Show

National Restaurant Association

May 19-22, 2018

Chicago, IL

ALL IN THE FAMILY

Across the Universe: SpacePole

SpacePole (Atlanta, GA) has debuted its universal mount for payment terminals, dubbed "MultiClip." It works with the company's family of modular pole and mounting solutions, including its DuraTilt, Stack, and Low Profile, and supports the Lane 5000, Lane 7000, and Lane 8000 payment terminals by Ingenico. It furnishes simple, click-in-place mounting and quick-release removal of the payment terminals, according to SpacePole.

Intended to facilitate upgrade of payment terminals--without associated costs and complications--SpacePole's MultiClip features discrete and minimalist design. As well as working with Ingenico, SpacePole engaged Kensington to develop its push-lock for anti-theft security for the MultiClip. "SpacePole MultiClip takes payment mounting solutions to a new level of functionality and ease of use in line with the payments transactions environment in which commerce operates today, and tomorrow," expounded SpacePole.

An arm of Ergonomic Solutions, which is based in the U.K. and manufactures in Denmark, SpacePole has fulfilled over five million installations, and in retail, supplies 60% of the Global Top 50. It distributes through BlueStar (Hebron, KY) and ScanSource (Greenville, SC), and runs its cleverly tagged "Space Program" for VARs and ISVs. In addition to Ingenico, it has solutions for payment terminals by Verifone (as well as popular tablets for POS).

MultiClip Payment Terminal Mount by SpacePole

A Pulse Races at Touch Dynamic

Touch Dynamic (South Plainfield, NJ) has unboxed its Pulse Ultra All-in-One POS, with "more features and an attractive look," in the words of CEO Craig Paritz. Updating the Pulse, first released in 2011, this new terminal measures approximately 13 in. (H) x 15 in. (W) x 9 in. (D), with MSR. It carries 15" projected-capacitive touchscreen (1024x768) with true-flat, bezel-free design and 0-to-140-degree tilt angle. It's also compatible with the next-generation enclosed printer base by Touch Dynamic.

A trio of processors are offered: Intel Celeron Quad-Core J3455 at 1.5 GHz, Intel Skylake i3-6100U at 2.3 GHz, and Intel Skylake i5-6300U at 3 GHz. It includes 4-GB/8-GB RAM, Intel HD Graphics, and 2.5" SATA Solid-State Drive. A full suite of ports is furnished: USB 2.0 x 2, USB 3.0 x 4, Serial with DB9 Adapters x 3, Serial Powered with 5V/12V by BIOS x 4, Gigabit LAN (10/100/1000) x 1, and RJ-11 Cash Drawer x 1.

As O/S, the Pulse Ultra has Windows 10 Pro and IoT (with the J3455 CPU), and Windows POSREADY 7, Windows 8.1 Embedded Industry Retail Pro, and Windows 10 Pro and IoT (with the i3 and i5 CPUs). Accompanying peripherals have been enhanced in the Pulse Ultra, in particular with Augusta MSR/EMV Reader by ID TECH (Cypress, CA) and "SteelCoat" Fingerprint Reader by Crossmatch (Palm Beach Gardens, FL). Also, 2x20 VFD and 8" or 15" customer-facing displays are optional.

Ultra Pulse All-in-One From Touch Dynamic

Join the Party at No Charge

|

|

|

|

|

|

||

|

|

||

|

|

|

|

|

|

||

Do you need to reach the POS & Auto ID resellers who really drive business? With the most targeted editorial environment, and on the most cost-effective basis?

E-mail

Michael Kachmar for advertising information,

or call 973-270-3284

Did you miss one of our issues and suddenly realize your competitors know more than you do?

Hurry ! Use the links below to catch up :

ALLIANCES

An Engagement Ring in Auto ID

An interesting strategic partnership has been established between two of the major players in our channel--Datalogic (Eugene, OR) and TSC Auto ID (Brea, CA). Under this agreement, the two companies will cooperate in marketing their solutions--scanning for Datalogic, and printing for TSC Auto ID. They share many common customers and channel partners. They also compete with scanner/printer entities Zebra Technologies Corporation and Honeywell Scanning & Mobility.

As an early example of collaboration, the two firms cited the Datalogic Matrix 120 ultra-compact two-dimensional scanner in use with the TSC MH240 thermal barcode printer. In this configuration, so-called "read after print," the Matrix 120 audits each label produced by the MH240. "Our customers can take advantage of complete solutions, be certain of the quality of the supply, and with the guarantee of the best-performing certified solution by both manufacturers," suggested Francesco Montanari, Chief Marketing Officer of Datalogic.

"We look forward to working closely with Datalogic on a global level and providing customers valuable solutions with complementary and compatible products from Datalogic and TSC," relayed Sam Wang, CEO of TSC Auto ID. In North America, TSC, which owns the thermal printer brand of Printronix, has reconfigured its sales force with the hire of three industry veterans: Rick Parrott, formerly of Zebra Technologies, for the Eastern Territory; Brian Rafael, formerly with an unidentified Auto ID VAR, for the Midwest Territory; and Darren Kerr, formerly of Honeywell Scanning & Mobility, for the Western Territory. It reports significant growth in the Americas for its desktop and industrial family.

ISVs See To It (Ctuit)

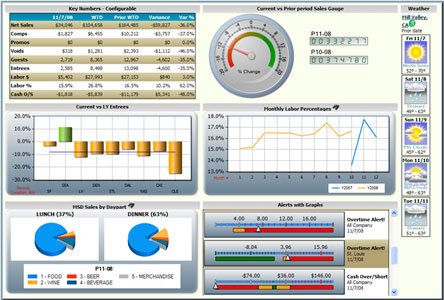

A pair of historic POS ISVs, SpeedLine Solutions (Vancouver, BC, Canada) and Future POS (Butler, PA), have added the restaurant management software of Ctuit. This solution, entitled "RADAR," spans sales, scheduling, and payroll. It features custom dashboards, several hundred widgets, and optional modules for mobility, alerts, and fraud prevention. Presently, it ties to more than 70 partners in POS.

"This integration gives our restaurant clients the choice of new tools to control costs, increase sales, and manage their businesses," stated Mike Anderson, Product and Development Manager at SpeedLine Solutions, which focuses on the pizza market. "We are committed to providing our customers with the best choice of solutions to run their restaurants," exclaimed John Giles, President of Future POS, which has been brought into the Lighthouse Network. At Ctuit, Michael Kapash serves as Director of Strategic Partnerships.

Earlier this year, in July, Ctuit was acquired by rival Compeat (Austin, TX). Citing "highly complementary businesses," Jeffrey Stone, CEO of Compeat, continued, "combination of these two great companies will provide our customers with more choices and an obvious accounting, back-office, and workforce market leader. Our customers and employees are going to be the true beneficiaries of this combination."

SpeedLine and Future POS Adopt Ctuit RADAR

Code Corner

Datacap Systems (Chalfont, PA), which supplies its popular integrated payments middleware--NETePay--has completed U.S. EMV Level 3 Certification with processor Moneris Canada (Toronto, ON, Canada). NETePay for Moneris POSPad utilizes the iPP 320 from Ingenico. It adds new features such as Point-to-Point Encryption (P2PE), tokenization, EMV store and forward, and automatic updates. It also adds support for "Tap and Pay," or contactless EMV, which has gained popularity in Canada. It also pairs with Datacap's GIFTePay solution, which integrates with two dozen third-party gift card providers. "With nearly half of the payments market share in Canada, Moneris is a key Canadian partner for Datacap's point-of-sale integrators," reported Justin Zeigler, Director of Product Strategy at Datacap Systems. "A feature-packed update to our existing Moneris release empowers our partners to capitalize on even more sales opportunities."

ENVIRONMENTS/PLATFORMS

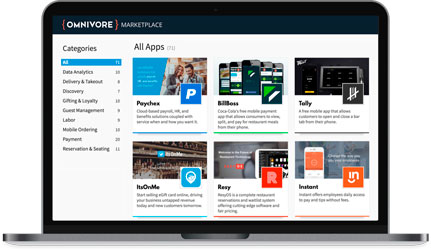

A Growing Appetite for Omnivore

Omnivore (Hayward, CA), the cloud-based "Universal" API (Application Programming Interface) between third-party solutions and hospitality POS, has enlisted payments specialist, Spreedly (Durham, NC). As part of the Omnivore App Marketplace, opened in February, Spreedly ties to over 100 gateways, with support for Payment Card Industry (PCI) Compliance. It joins emerging players in payments, reservation/seating, deliver/take-out, gifting/loyalty, mobile ordering, guest/event management, workforce, and data analytics/business intelligence.

"Omnivore's new collaboration with Spreedly provides even stronger optionality and value to our customers," enthused Mike Coppola, Chief Brand Officer for Omnivore. "App developers are now able to offer their clients flexible, secure, and simple payments solutions at an advanced level of service. Spreedly's tokenization product powers card-present and card-not-present payment solutions that were previously unavailable to our restaurant customers."

Started in 2014, Omnivore also lists major players such as Oracle-Micros, NCR Aloha, Agilysys-InfoGenesis, Heartland-Dinerware, Lighthouse Network-POSitouch, and PAR Brink POS as POS ISVs. A dozen POS VARs participate (as of mid-year): Big Apple Hospitality, California Retail Systems, Crescent Business Machines, Custom Business Solutions, Data Business Systems, Infinity Restaurant Technology, Missouri Restaurant Solutions, Penn Center Systems, Pinnacle Hospitality Systems, POS Technical Services, Retail Systems Inc., and United Standard POS. "Each of the dealer partnerships we have added in 2017 has been strategically selected," shared Mike Wior, CEO and Co-Founder of Omnivore.

Omnivore App Marketplace for Hospitality

Vend: Connecting the "Dotts"

Vend (San Francisco, CA), notable member of the next generation of retail management software providers, has unveiled its artificial intelligence (AI), styled "Dott." It examines sales, product, customer, and inventory information for merchants utilizing the Vend Platform. It then offers personalized suggestions for improving their business.

In its first release, this will include customer engagement and best inventory practices. As it progresses, Dott intends to gather market intelligence from tens of thousands of retailers on the Vend Platform. At that point, it will key retailers on new product trends and customer behavior, provide reminders to replenish stock or fulfill an order, and "keep an eye on things 24/7." It follows earlier enhancements to the Vend Platform, including redesigned dashboard, suite of promotional tools, and mobile inventory app, christened "Scanner by Vend."

"Introducing Dott means the system can learn things about retail and develop insights that haven't been available before for small-to-medium retail store owners," suggested Vaughan Rowsell, Founder of Vend, and now Chief Product Officer. "We're really pumped about this launch, and did we mention--we're hiring." Over the next six months, he expects to grow his product and engineering teams by 25% as part of the push into AI and Big Data (in the home country of New Zealand).

Artificial Intelligence, Called Dott, by POS Provider Vend

Key Advertiser Links

Be sure to visit these vendors for the latest in channel products

and offers for resellers.

POS & Peripherals

Aures

Bematech

Harbortouch

Hewlett-Packard

Pioneer POS

Poindus America

POSBANK USA

Posiflex

Tailwind Solutions

API & Marketplace

Omnivore

Barcode & Transaction Printers

Brother Mobile

CognitiveTPG

Godex Americas

Honeywell

Cash Drawers

APG Cash Drawer

MMF POS

Data Collection

CipherLab

Code Corporation

Denso ADC

Honeywell

Janam Technologies

Distribution

Ingram Micro

Integrated Payment Solutions

Datacap Systems

Cayan

iPayment

Monetary LLC

Payment Logistics

Sterling Payment

Keyboards & Mobile POS

Cherry Americas, LLC

TG3 Electronics

Mounts for POS

Innovative

SpacePole

Receipt Printers

Bixolon America

CognitiveTPG

Epson America

Star Micronics

Thermal Printers

Seiko Instruments USA

INSTALLATIONS

Equinox Sets Out the China

Equinox Payments (Scottsdale, AZ) now supports electronic payments through China's UnionPay International. Specifically, the Luxe Series and Model L5300 from Equinox now handle contact and contactless chip technology for EMV in both debit and credit cards by UnionPay. Established in 2002, UnionPay operates the inter-bank clearing and settlement system in China (and has issued more than two billion cards). Its transactions are routed through Discover Network and Pulse in the U.S.

"We are honored to be the first domestic terminal provider to add support for chip and contactless cards for UnionPay," remarked Rob Hayhow, VP at Equinox Payments. According to the U.S. Department of Commerce, nearly four million Chinese mainland tourists will visit the U.S. in 2017, equaling 15% year-over-year growth. They average $5,000 in spending per trip. Additionally, there are over 400,000 Chinese students enrolled in colleges and universities in the U.S.

A mobile solution, the Luxe 6000m has 2.4" LCD, and modules for power, receipt printing, and wireless (Bluetooth Low Energy, Wi-Fi, 4G LTE). At the counter, the Luxe 8000i has 5" or 7" LCD, signature capture capacity, and Linux/HTML5. With an installed base in retail, and multi-media, the Model L5300 addresses high-volume, multi-lane environments. A set of China UnionPay Application Identifiers (AIDS)--one debit, one credit, one quasi-credit, and one common debit for U.S.--are supported via kernel for the People's Bank of China.

Equinox Payment Terminals Support UnionPay

Zebra Deals the Cars

A new scheme for tracking vehicles on the dealer's lot has been fashioned by Zebra Technologies Corporation (Lincolnshire, IL), ISV CP Handheld Technologies (Ft. Lauderdale, FL), and VAR Miles Data Technologies (Waukesha, WI). Implemented at the Greenway Auto Group in Orlando, FL, it employs VINPoint software by CP Handheld with the TC75 touch computer and ZT230 industrial barcode printer by Zebra. At this site, Greenway holds 1,700 to 2,000 vehicles on 25 acres.

Under this procedure, vehicles arriving on the lot are recorded in VINPoint. "At that time, the Zebra ZT230 prints five all-weather labels for each vehicle," explains Zebra. "They can be used for the vehicle, deal jacket, and key fobs. Once the vehicle is labeled, Zebra's TC75 touch computer scans and produces the GPS location for each car. That information is captured and sent to the server wirelessly using the cell phone SIM chip." A web portal displays time and location of tracking.

"Car inventory has always been a challenge for us from an accounting and sales perspective," disclosed Roy Snoeblen, Controller at the Greenway Auto Group, "With VINPoint and Zebra's TC75, we cut the time to inventory the cars by 60%, which improves our overall process. It frees up our time to do other tasks that improve the overall efficiency and effectiveness of our dealership." At present, CP Handheld Technologies serves approximately 1,000 car dealerships in the U.S.

Zebra's Android TC75 Touch Computer and ZT230 Industrial Barcode Printer Track Inventory of Greenway Auto Group

Channel Factoid

It appears consumers are ready to say goodbye to passwords. According to a new survey by Visa, conducted by AYTM Market Research, 86% are interested in using biometrics to verify identity or to make payments, and 65% are already familiar with biometrics. In this survey, 70% of respondents find biometrics easier than passwords and 61% consider it faster. Also, 50% of respondents feel the top benefit of using biometrics is eliminating the need to remember multiple passwords or PINs, while 46% feel biometrics is more secure than multiple passwords or PINs. (A third of consumers, the survey found, use unique passwords for each of their accounts.) In terms of technology, consumers are most familiar with fingerprint recognition, with 30% having used it once or twice and another 35% using it regularly. By comparison, 32% have used voice recognition in the past and only 9% use it regularly. "Advances in mobile device features are increasing the accuracy and speed of biometrics, such that they can be used for financial transactions," observed Mark Nelsen, SVP of Risk and Authentication Products for Visa. "At the same time, consumers are widely familiar and comfortable with using biometrics for more than just unlocking their phones."

Consumers Growing Comfortable With Biometrics

HELLO GOODBYE

A Band of Brothers

A leading player in printing and labeling, Brother Mobile Solutions (Westminster, CO) has expanded its reseller effort with the hiring of its first Channel Account Manager, Gia Colanero. She brings ten years of experience, most recently as Regional Sales Manager for Getac (April to December 2017). Previous roles have included Regional Sales Manager for Barco (2015 to 2017) and Partner Sales Manager for Panasonic (2012 to 2015).

"Gia will be instrumental in working closely with our partner community to drive awareness of BMS product solutions and services, implement sales enablement activities, and establish a closer and more productive relationship with our partners," commented Greg Korovilas, Distribution/DMR Sales Manager for Brother Mobile Solutions. Shared Colanero, "I'm honored to be part of the successful, energetic, and growing team at Brother, and I'm thrilled to help take our channel partners and Brother Mobile Solutions into a record-breaking year."

In September, Brother Mobile Solutions launched its NEXT Partner Program. Grounded in "functional items" such as effort, cooperation, and growth potential on the part of VARs--rather than concentrating solely on sales volume of products--it has Gold and Silver Tiers. As benefits, it furnishes leads, deal registration, demo units, marketing support, and access to product roadmaps. A Partner Portal supports NEXT. "We want to see new players, and new verticals, get equal love," Ravi Panjwani, VP of Marketing, Product Management, and Business Development at Brother Mobile Solutions, told RRN.Com in September

Gia Colanero, Channel Account Manager, Brother Mobile Solutions

A Wise Man at iPayment

One of the payment processors active in our channel, iPayment (Westlake Village, CA), has added William "Bill" Wade to its Board of Directors. With an extensive background in payments, online commerce, and financial services, Wade serves as CEO and Founder of Company.com (2008 to Present) and Chairman and Founder of Gaming Network Solutions (2011 to Present). Other successful firms he has started, led, or invested in include Breezio, Sage Software (Payments Division), Verus Financial Management, and Network 1 Financial.

"We are delighted to have Bill join our Board, and I look forward to working with him in this new capacity," stated O.B. Rawls IV, CEO and President of iPayment, Inc. "Bill has a keen understanding of the SMB marketplace and what businesses are looking for from their service providers. His experience as an entrepreneur, innovator, and successful CEO will be invaluable to iPayment's leadership, our partner network, and our customers."

"I've had the pleasure of working with iPayment for a number of years, given its partnership with Company.com," recounted Wade. "Our two organizations are well aligned in that we both aim to provide differentiated and valuable solutions to help businesses achieve their goals. I'm looking forward to contributing fresh insights to help iPayment continue its success and expand its offerings in the SMB."

William Wade Joins Board of Directors at iPayment

Acceleration at Apriva

Apriva (Scottsdale, AZ) has drafted payments industry veteran Scott Dowty as its Chief Revenue Officer. His past positions include Chairman and Co-Founder of Passport Technology (2016 to Present), EVP of Enterprise Sales at CardConnect (2014 to 2017), EVP of Sales and Chief Marketing Officer at Global Cash Access (2005 to 2014), and SVP and GM at First Data Corporation (2000 to 2005). He also served on the Payment Card Industry (PCI) Council from 2014 to 2017.

"Scott comes to Apriva with a demonstrated track record in leading high-achieving sales teams," cited David Riddiford, President of Apriva. "We look forward to Scott extending Apriva's market leadership in self-service and attended card-present payments, and opening new markets for our technology platform."

"Apriva's impressive technology stack together with management's desire to transform the business in the highly dynamic payments space is exciting," contributed Dowty. "Significant opportunity abounds to organizations willing and able to pivot, and Apriva has all the necessary assets to expand its leading position." A technology developer since 2003, Apriva has two operating groups: Apriva Point of Sale and Apriva Information Security Systems.

Scott Dowty, Chief Revenue Officer, Apriva

PinPoint Media

All Rights Reserved