Michael Kachmar, Editor

(If your e-mail client does not display this properly, click here.)

This Week’s Product Pick

Honeywell Scanning & Mobility (Fort Mill, SC) unveiled its Dolphin 7800 enterprise digital assistant (EDA) for mobile workers. Built with magnesium inner chassis and engineering-grade plastic housing, the Dolphin 7800 measures 6.2 in. (H) x 3 in. (W) x 1.1 in. (D) and weighs 11.4 oz. with standard battery. System architecture includes Microsoft Windows Embedded Handheld 6.5, 800-MHz TI OMAP processor, and 256-MB RAM x 512-MB Flash. Adaptus Imaging Technology 6.0 enables fast scanning of linear and two-dimensional barcodes, augmented by an integrated three-megapixel color camera. Additional features include 3.5-inch outdoor-viewable VGA touchscreen display, multiple keyboards, and software-definable radio capability that allows on-the-fly switching between GSM and CDMA networks (as well as Wi-Fi, Bluetooth, and GPS). "Dolphin 7800 delivers advanced technology and durability in smaller form factor--which is just what our customers have been asking for,” stressed John Waldron, VP of Worldwide Marketing for Honeywell Scanning & Mobility.

Dolphin 7800 EDA by Honeywell

COMPANY BUSINESS

Retail Redux for Intermec

Intermec (Everett, WA) has stepped back into the retail arena with the introduction of its SG10T handheld barcode scanner. This new device, with list price of $140, was stocked at the company’s three main distributors--BlueStar, ScanSource, and Ingram Micro Data Capture/POS--starting in September, RRN.Com was told by Paul Denimarck, Principal Product Manager at Intermec. “With products in this category--entry-level, low-priced, basic-performing--availability is typically the key metric in making the sale, so we made sure the distribution channel would have the product before we announced it to our partners,” Denimarck explained.

SG10T employs durable solid-state imaging technology to read all common one-dimensional symbologies. Its ergonomic form factor measures 6.5 in. (L) x 2.6 in. (W) x 2.1 in. (H), weighs slightly less than 4 oz. without cable, and delivers 130 scans/second in point and shoot operation. Described as “working out of the box,” with either USB or keyboard wedge, SG10T also furnishes Intermec’s EasySet web-based programming utility. For added value, it comes backed by the company’s three-year warranty.

Intermec has focused on the narrow-channel, high-value warehouse space for some time now, so the SG10T represents the first step toward providing more mainstream products for non-industrial environments, most prominently retail and professional services. “It enables the partners in the channel who currently support our product line of computers and printers to offer an entire Intermec solution,” observed Denimarck. “In many cases, we would see cross-branded devices for scanning attached to our products because we didn’t address this space. SG10T is the first product in this category we’re releasing, with more to follow. We want to send the resounding message that Intermec is back in this business.”

Intermec’s SG10T General-Duty Linear Scanner

Gift Cards Routed to Small Merchants

Precidia Technologies (Ottawa) has showcased GiftVu, its gift card system for merchants with fewer than one thousand such transactions per month, per location. GiftVu features customer log-in for card reload, fast transactions, and 24/7 remote access to transactional data. Further, merchants already using the company’s POSLynx220 payment processing router with TransNet may implement GiftVu easily and simply by ordering gift cards and logging in to the dedicated portal to activate their locations. This is no more complicated than adding new BIN ranges, according to the company.

“There are many gift card programs available to mid and large-sized merchants, but these are often out of reach for small merchants,” offered Deepak Wanner, President of Precidia Technologies. “GiftVu is ideal for these merchants, giving them an easily managed and flexible solution at a fraction of the cost of other available options. We’re pleased to give small businesses another tool that will enhance their competitive position.”

From its central dashboard, GiftVu allows the setting of card expiration dates, valid locations for card use, and reload limits for individual cards or groups. A snapshot of transactions, refunds, and balances for the day, week, or month may be viewed. As another benefit, GiftVu may be customized for individual merchants, proving familiar look and feel when cardholders and staff are using the portal. Not coincidentally, NetVu serves as Precidia’s web-based management server for device and network support.

POSLynx220 Payment Router by Precidia

Worth Your While

2012 Events

NRF 101st Annual Convention & Expo

National Retail Federation

January 15-18

New York

INSPIRE 2012

Retail Solutions Providers Association (RSPA)

January 29-February 1

Herradura, Costa Rica

MODEX 2012

Material Handling Industry of America

February 6-9

Atlanta

2012 Annual ETA Meeting & Expo

Electronic Transactions Association

April 17-19

Las Vegas

NRA Show 2012

National Restaurant Association

May 5-8

Chicago

GS1 Connect Conference

GS1 US

June 4-7

Las Vegas

ALL IN THE FAMILY

Epson Banks on More RDC

Epson America (Long Beach, CA) debuted its TM-S2000 multifunction payment device for banking, back counter, and remote deposit capture (RDC) settings. This new desktop device carries industry-leading functionality, according to the vendor, in critical areas such as check processing speed, MICR accuracy, and image quality. Additional benefits include an optional three-track magnetic-stripe reader, two-sided ID scanner, up to 15 lines of endorsement printing, and two-year warranty.

Further, Epson’s TM-S2000 incorporates OCR-A and OCR-B font recognition, which is typically used on computer-generated invoices. When the customer’s payment coupon gets scanned, account information can be retrieved automatically. Featuring compact footprint of approximately 7 in. (H) x 10.4 in. (D) x 10 in. (W), and USB 2.0, the product’s design employs recessed connectors, fewer covers and moving parts, and self-diagnostics to minimize maintenance time and improve ease of operation.

“The TM-S2000 delivers top-of-the-line quality,” commented Mike Helm, Director of Sales and Marketing, Epson Business Systems Division. “It’s designed for end-users who need robust RDC and also want to perform other customer service transactions without investing in additional hardware. Utilities, municipalities, check cashing stores, and other businesses who accept walk-in check payments can reduce transaction time and speed customer service with the TM-S2000’s combination of check capture and payment processing features.”

TM-S2000 Multifunction Payment Device by Epson America

[Editor’s Note: Epson America also announced that its TM-T20 thermal receipt printer will be offered by TransFirst (Hauppauge, NY) as part of its Transaction Express payment gateway configuration. Transaction Express provides online payment processing through any web-connected device for retail, e-commerce, government, utilities, and healthcare. “Our merchants are looking for an alternative to laser and ink-jet invoice printing, which can be very costly,” relayed Craig Tieken, Director of Product for TransFirst. “The Epson TM-T20 is a great fit.”]

A Keyboard With Benefits

Key Source International (Oakland, CA) has enhanced its KSI-1700 keyboard with the pcProx reader from RF IDeas (Rolling Meadows, IL), which provides error-free identification of over 300 million proximity and contactless smart cards and credentials for physical access in use worldwide. This embedded reader is easily identified by the WaveID logo located on the keyboard, which typically characterizes technology from RF IDeas. “Logo placement helps users find the correct location to present their credential for identification and authentication,” noted Richard Landuyt, President of RF IDeas.

Introduced to the channel at BlueStar’s VARTECH Show in Miami in August, the KSI-1700 Series was expressly designed to accommodate advanced security schemes in near-field communication (NFC), RFID, biometrics, and access cards. In addition to WaveID, the most recent model offers SonarLocID, which automatically logs off when users walk away. Despite its next-generation capabilities, the KSI-1700 features an ergonomic design that allows for clean, uncluttered workplaces, according to its manufacturer.

“The 1700 Series keyboard system gives us the ability to mix and match multiple options of integrated security and Auto ID devices into one elegant desktop solution,” declared Phil Bruno, SVP of Sales and Marketing for Key Source International. “Partnering with RF IDeas, and their WaveID, allows us to leverage legacy technology and deliver this cost-effective, strong authentication system to help our customers replace passwords and meet government compliance.” KSI markets through distributors such as Envoy Data, POSDATA, Tekserve POS, and Think Computer Products, in addition to BlueStar.

Key Source’s KSI-1700 Keyboard Adds WaveID by RF IDeas

Join the Party at No Charge

Do you need to reach the POS & Auto ID resellers who really drive business—in the most targeted editorial environment, and on the most cost-effective basis?

E-mail Michael

Kachmar for advertising information,

or call 973-270-3284

Did you miss one of our issues and suddenly realize your competitors know more than you do?

Hurry ! Use the links below to catch up :

PARTNER PROGRAMS

Matriculation for Merchant Warehouse

Merchant Warehouse (Boston), one of the leading payment processors utilizing the POS channel, has demonstrated its support for the Electronic Transactions Association’s Certified Payments Professionals (CPP) program. Three years in the making, CPP seeks to raise competency for professionals in the electronic payments industry. To gain certification, sales agents (with at least one year of experience) must complete and pass the ETA’s 125-question multiple choice exam, offered twice per year at hundreds of sites across North America. For this month’s test, the first to take place under the program, ETA seeks to approve 300 individuals.

To support that goal, Merchant Warehouse has 80 of its employees and independent sales agents participating, including Co-CEO Henry Helgeson. “The payments industry has always been a very competitive market with only the most knowledgeable and aggressive agents finding their way to success,” Helgeson remarked. “This certification program rewards the sales professional who strives to go further than their competition. Other professions have similar programs to signify certain professionals are more qualified than others. This is a mark of distinction that Merchant Warehouse supports and aims to have 100% of our agents CPP certified.”

Cost for the exam is $325 for ETA members, such as Merchant Warehouse, and $425 for non-members. A $200 retest fee applies to any sales agents not passing the exam and wishing to retake it, however they must wait until the next testing period. Certification lasts three years and may be supplemented by classes and training provided over the ETA website.

Henry Helgeson, Co-CEO, Merchant Warehouse

TSYS Splashes in Pool of Prospects

TSYS Merchant Solutions (Columbus, GA), rated as the tenth largest merchant acquirer in the U.S. by dollar volume, has been tapped as the exclusive payment processing partner of The Association of Pool & Spa Professionals (APSP). By partnering with TSYS, APSP members will have access to preferred pricing, hardware and software solutions, 24/7 customer and technical support, and e-commerce capacity. Indeed, on its website, APSP notes that TSYS will beat any member’s current credit card processing rate or pay out $500.

“The ability to easily and securely accept any type of payment has become a fundamental element in maintaining dealership customer satisfaction, and is a critical component to any pool, spa, and tub business,” stated Bill Weber, CEO of The Association of Pool & Spa Professionals. “TSYS Merchant Solutions offers a secure, low-cost answer to this problem, allowing members to focus on what they do best--running their businesses.” Based in Alexandria, VA, APSP purports to be the world’s largest trade group in its area of focus.

“We are honored APSP has chosen to trust us with members’ processing needs and look forward to a long relationship,” confirmed Chris McNulty, Senior Director of Business Development and Sales at TSYS Merchant Solutions. “Our team of industry experts is standing by and ready to begin work with dealers to deliver solutions that are tailored to their individual needs.” Last month, TSYS purchased the merchant portfolio of Vanguard Payment Systems (Clearwater, FL), which serves fine dining restaurants and high-end medical and dental vertical markets.

New Referral Relationship with The Association of Pool & Spa Professionals for Payment Processor

Code Corner

NCR Corporation (Duluth, GA) launched Usherman, its new ticket retrieval and scanning application. Compatible with the Apple iPod Touch 4G, Usherman may be downloaded from the Apple iTunes store. Using an integrated sled that enables card swipes and reads barcodes, purchases can be found by confirmation number and credit, gift, or loyalty card. Usherman seamlessly links with Radiant POS, owned by NCR, and empowers theater employees to quickly serve consumers who prefer the convenience of online ticketing. With this module, they can scan and retrieve tickets movie patrons have printed at home or transferred to their smart-phones. As an early adopter, Cobb Theatres has piloted the Usherman solution in its premier cinema and dinner-and-movie concept, CineBistro in Atlanta. “Consumers continue to expect convenience and fast service when they go to the movies,” said Brian Whitney, Director of Business Development, NCR Hospitality and Specialty Retail. “Usherman not only enhances the guest experience, it is integrated with the POS to make sure all ticketing information is captured and stored in one database.”

ALLIANCES

Grocery Up “Next” for Sundrop Mobile

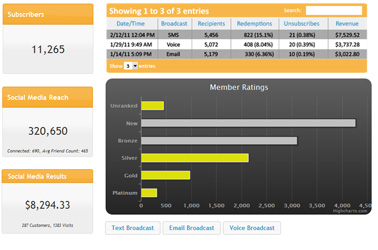

Sundrop Mobile (Maitland, FL) has tied its mobile marketing and loyalty product to StoreNext’s ISS45 POS system for grocery. First deployment has taken place at Checkers in Lawrence, KS, as part of the Give Back community business and charitable network. Under Give Back, Sundrop Mobile’s platform allows consumers to earn points and redeem accumulated store value credit at 75 participating merchants. “Checkers is a high-volume local grocer and cornerstone member of Give Back,” indicated Constance Wolfe, the program’s founder. “Having Sundrop Mobile Loyalty integrated so seamlessly into the grocer’s POS boosts participation and greatly simplifies the entire operation.”

Working in conjunction with POS, Sundrop Mobile Loyalty replaces plastic loyalty cards with customers’ mobile phone numbers. This works to boost participation while eliminating any need for merchant administration, since Sundrop automatically manages acquisition of additional customer demographics. Further, the scheme seamlessly integrates social media (such as Facebook and Twitter) and location-based services and tracks return-on-investment results via its closed-loop marketing process.

StoreNext represents the latest in Sundrop Mobile’s push into the ISV POS realm; earlier, the start-up forged relationships with Maitre’D by Posera, Dinerware, and Microsoft Dynamics RMS. In an interview with RRN.Com, company spokesmen pointed to another imminent integration for hospitality, as well as possible participation in two-tier distribution. StoreNext, based in Plano, TX, spun out of Fujitsu Transaction Solutions and Retalix USA in 2002 to address the independent grocery market, and has subsequently added IBM’s SurePOS to its line card.

Sundrop Mobile’s Customer Tracking Methodology

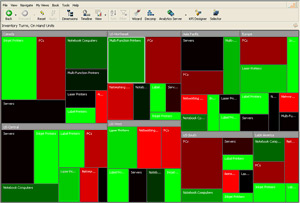

A Fire Hose of POS Data

Accelerated Analytics, part of the Rainmaker Group (Akron, OH) will offer ready access to aggregated POS sales data from some of the world’s largest retailers through the GXS GridConnect Partner Program. Launched earlier this year by GXS (Gaithersburg, MD), GridConnect enables ISVs, SaaS vendors, and cloud service providers to embed the GXS Trading Grid directly into their applications. For vendors who work with dozens or hundreds of retailers, this eliminates up to 20 hours of work each week digesting spreadsheets or EDI 852 documents from thousands of stores, according to the two parties. Moreover, vendors can reduce set-up times from weeks to days and bypass repeated sign-offs from operations, technology, and legal departments.

“GXS is already the trusted partner of our customers, who kept asking us ‘Are you on the GXS Trading Grid?’” recounted Chad Symens, President of Accelerated Analytics. “By offering pre-connected access to thousands of retailers, we can help our customers spend more time on analyzing sales and less time setting up connections and formatting data.” By using the pre-built views in the cloud-based service, vendors can quickly identify problem stores and avoid out-of-stocks, he emphasized.

“It’s great to see the positive feedback that these types of cloud integration provide to retailers and vendors,” shared Andrea Brody, VP of Business Development at GXS. “We’re happy that our partnership with Accelerated Analytics can give suppliers this simple, stable, and secure way to connect to the retailer ecosystem.” GXS serves more than 400,000 companies, including 75% of the Fortune 500 and 23 of the top 25 supply chains, helping to extend their partner networks, automate processes, and manage electronic payments, according to the service provider.

Sales Performance Map by Accelerated Analytics Colorizes Product Sales by SKU Numbers and On-Hand Units

Key Advertiser Links

Be sure to visit these vendors for the latest in channel products and offers for resellers.

POS & Auto ID Distribution

BlueStar

ScanSource

POS & Peripherals

Casio America

Logic Controls

Posiflex

POS-X

Touch Dynamic

POS Systems - Hospitality

PAR

Barcode & Transaction Printers

Datamax-O'Neil

Zebra Technologies

Cash Drawers

APG Cash Drawer

MMF POS

Data Collection Terminals

CipherLab

Datalogic Mobile

Janam Technologies

Data Collection Software

Wavelink

Integrated Payment Solutions

Datacap Systems

Merchant Warehouse

WorldPay US

Keyboards

Cherry, ZF Electronics Corp.

Mobile Marketing & Loyalty

Sundrop Mobile

Receipt Printers

Bixolon America

Citizen Systems America

Epson America

Star Micronics

Thermal Printers

Seiko Instruments USA

INSTALLATIONS

Squirrel Gets Frisky at Resorts

Squirrel Systems (Vancouver, BC, Canada) will roll out its Professional POS platform for Boyne Resorts, one of the largest family-owned vacation networks in North America. Squirrel will support 36 outlets for food and beverage in the four locations in Michigan and Montana, namely Boyne Highlands Resort, Boyne Mountain Resort, The Inn at Bay Harbor-A Renaissance Golf Resort, and Big Sky Resort. These include fine and casual dining restaurants, bars, and quick-service cafes, with overall networking allowing consolidated sales reports.

In addition to meeting all of the requested functional requirements, Squirrel Professional POS proved to be cost-effective, according to the two parties. Ryan D. Kneeshaw, Business Technology Analyst at Boyne Resorts, elaborated, “Squirrel’s feature-rich software is built on the robust Microsoft SQL technology platform, which allows us to use our existing terminals and printers. As a result, our original POS hardware investment has been protected.” Reportedly, strong mobile support was another consideration, with Squirrel Mobility linking devices such as Apple iPad and iPhone.

“Our proven technology and talented implementation and support team will help Boyne Resorts make an easy transition from their current POS software to Squirrel Professional,” commented Mike Devine, VP of Marketing and Channel Sales at Squirrel Systems. “We've pioneered point-of-sale since 1984 with headquarters located in close proximity to one of the world’s best ski resorts, where we have many satisfied Squirrel customers. This combined experience in food and beverage and resort operations will ensure the successful implementation and support of Squirrel’s hospitality management solutions at Boyne’s various properties.”

Squirrel Professional POS Deployed by Boyne Resorts

Texas RFID Ranger

Radiant RFID (Austin, TX) has enlarged its relationship with the Texas Department of Public Safety to include overall statewide tracking of assets such as computer equipment, communication devices, and protective gear. Radiant RFID’s online location functionality, through Virtual Asset Tracker, eliminates paper forms and manual entries previously required to transfer items as people are moved from department to department. Instead, the system sends an e-mail to the receiving department’s property custodian, who then accepts or rejects an asset transfer request. Radiant RFID utilizes Motorola’s FX7400 and MC3090 hardware, and now claims to track over $1 billion in property.

“We have been working with Radiant RFID for several years using their services to track evacuees during hurricanes while also ensuring our emergency management equipment and related mobile devices are kept in a constant state of readiness,” reported Mark Doggett, CIO of the Texas Department of Public Safety. “It made sense for us to significantly deepen our existing relationship with Radiant RFID and apply their innovative technology to solve the challenge of tracking large numbers of devices and equipment across Texas.”

“We are proud to deepen our relationship with the Texas Department of Public Safety, the state’s premier law enforcement agency,” added Cynthia Rubio-Ratton, President and Co-Founder of Radiant RFID. “Similar to many large corporations, the Texas DPS needs to know the physical location of their numerous assets--at any given point in time. Through the use of GPS and RFID asset tracking technology, Radiant’s solution helps the DPS to know the location of all of their assets--even if those assets are transferred to new locations or departments.”

Radiant RFID, and Motorola’s MC3090, Track Assets for Texas Department of Public Safety

Channel Factoid

While they use social media personally and believe it affects their bottom line, the majority of small business owners don’t know how to leverage the new networks to build their companies, according to the new survey by Strategy1, which mines social media for business intelligence. What’s more, most don’t plan on investing until they understand necessary practices and resulting payoffs. Nearly three-quarters (73%) of small business owners said they access social networks on smart-phones or other mobile devices, yet 67% are restricting their own implementation. Three factors drive this decision: fear of sharing sensitive information (cited by 51%), belief that there’s too much social media to manage (50%), and overall information overload (44%). Among the 41% of small businesses taking any social action, the focus is solidly on promoting to increase brand awareness. This study engaged 350 small business executives, predominantly from companies with fewer than 10 employees. As advice to help them get started, Steve Ennen, President and Chief Intelligence Officer for Strategy1, urged small businesses to treat social media as the platform for listening, not talking.

HELLO GOODBYE

Savvy VP of Marketing for Savi

Savi Technology (Alexandria, VA), the wholly owned subsidiary of Lockheed Martin supplying RFID, has named Phil Juliano as its VP of Marketing. Juliano will be responsible for all related functions, such as market and product strategies, branding, public relations, and demand generation. He brings more than 25 years of senior-level experience, most recently serving as VP of Global Brand Management and Corporate Communications for Novell.

“Savi’s customers are working directly with us to develop innovative solutions to wirelessly track and monitor high-value assets on a global scale,” noted Bill Clark, CEO of Savi Technology. “Phil’s expertise in positioning and building high-performing marketing teams will be invaluable as we bring these real-world solutions to a broader market.” Savi’s portfolio spans tags, readers, and software for so-called active RFID at 433 MHz.

“The combination of Savi’s leading technologies and impressive customer base has created a significant opportunity to highlight and drive the company’s value in the marketplace,” Juliano said. “I am looking forward to working with the extended Savi team, its customers, partners, and industry analysts to promote a concise, compelling, and powerful promise of value to all key stakeholders.” In addition to Novell, Juliano’s previous employers have included Symbol Technologies, IBM, and advertising agency, Ogilvy & Mather.

Phil Juliano, VP of Marketing, Savi Technology

[Editor’s Note: At press time, it was reported that Lockheed Martin intends to sell Savi Technology, freeing the company to pursue commercial opportunities. Savi was purchased by Lockheed Martin in 2006, primarily to fulfill the Department of Defense’s need for an RFID-based supply chain.]

YESpay Here to Stay

YESpay (Toronto) has hired Mary Di Vincenzo as its new VP of Operations and Client Services for North America. Di Vincenzo brings over 20 years of experience spanning the financial, retail, payments, and technology industries to her new role. Previous posts include VP of Operations and Technology for STJ Retail, Owner of Aurora Systems Consulting, and IT Consultant at Chartwell, Inc.

“Mary is a highly skilled retail and payments professional who will undoubtedly bring significant expertise to our local operations in North America,” stated Rohit Patni, Co-Founder and EVP of Sales and Marketing of YESpay. “Her knowledge of certification and delivery of Bank and PCI solutions will continue to expand YESpay’s footprint as managed card payment server provider in Canada and the U.S.” Based in the U.K., YESpay entered the North American market in 2009 with its EMV Chip & PIN and PCI-DSS certified payment gateway, dubbed EMBOSS.

“YESpay’s value is based on key differentiating factors,” suggested Di Vincenzo, “such as significant reduction in the complexities, timelines, and costs traditionally associated with integrating, deploying, and maintaining EMV and PCI compliance for payment environments. This is really exciting news for integrators and merchants who, until YESpay’s launch in North America 18 months ago, had little choice but to spend several months and costs in the six figures. Essentially, we can deliver compliance in a few weeks for a nominal monthly fee, unlike our competitors.”

Mary Di Vincenzo, VP of Operations and Client Services, North America, YESpay

PinPoint Media

All Rights Reserved

.gif)